Python股票价格预测-ARMA-中国平安

发布时间:2021-12-03

公开文章

Talk is cheap

获取数据

import tushare as ts

pro = ts.pro_api('******************') # 到tushare官网注册账号获取token

ts_code = '300750' # 600600 .SH .SZ 工业富联601138 贵州茅台600519 宁德时代300750

ts_code = ts_code+'.SZ'

ts_code

'300750.SZ'

df = pro.daily(ts_code=ts_code, start_date='20210101', end_date='20210531')

df.head()| ts_code | trade_date | open | high | low | close | pre_close | change | pct_chg | vol | amount |

|---|

# 将日期设为索引

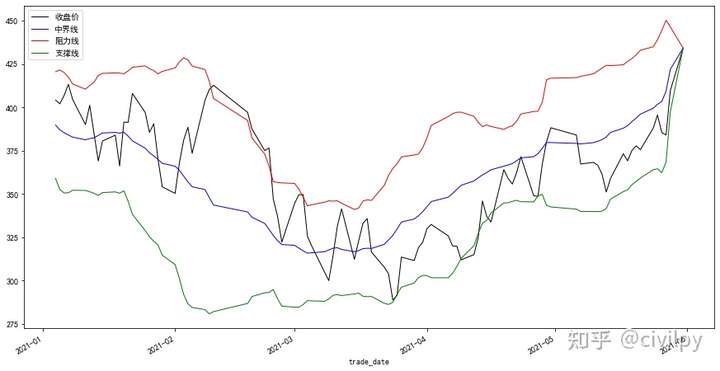

df.index = pd.to_datetime(df['trade_date'], format='%Y%m%d')布林线

# 导入及处理数据

import pandas as pd

import numpy as np

# 绘图

import matplotlib.pyplot as plt

# 设置图像标签显示中文

plt.rcParams['font.sans-serif'] = ['SimHei']

plt.rcParams['axes.unicode_minus'] = False

import matplotlib as mpl

# 解决一些编辑器(VSCode)或IDE(PyCharm)等存在的图片显示问题,

# 应用Tkinter绘图,以便对图形进行放缩操作

mpl.use('TkAgg')

%matplotlib inline

# SMA:简单移动平均(Simple Moving Average)

time_period = 20 # SMA的计算周期,默认为20

stdev_factor = 2 # 上下频带的标准偏差比例因子

history = [] # 每个计算周期所需的价格数据

sma_values = [] # 初始化SMA值

upper_band = [] # 初始化阻力线价格

lower_band = [] # 初始化支撑线价格

# 构造列表形式的绘图数据

for close_price in df['close']:

#

history.append(close_price)

# 计算移动平均时先确保时间周期不大于20

if len(history) > time_period:

del (history[0])

# 将计算的SMA值存入列表

sma = np.mean(history)

sma_values.append(sma)

# 计算标准差

stdev = np.sqrt(np.sum((history - sma) ** 2) / len(history))

upper_band.append(sma + stdev_factor * stdev)

lower_band.append(sma - stdev_factor * stdev)

# 将计算的数据合并到DataFrame

df = df.assign(收盘价=pd.Series(df['close'], index=df.index))

df = df.assign(中界线=pd.Series(sma_values, index=df.index))

df = df.assign(阻力线=pd.Series(upper_band, index=df.index))

df = df.assign(支撑线=pd.Series(lower_band, index=df.index))

# 绘图

ax = plt.figure(figsize=(15, 8))

# 设定y轴标签

ax.ylabel = '%s price in ¥' % (ts_code)

df['收盘价'].plot(color='k', lw=1., legend=True)

df['中界线'].plot(color='b', lw=1., legend=True)

df['阻力线'].plot(color='r', lw=1., legend=True)

df['支撑线'].plot(color='g', lw=1., legend=True)

plt.show()

df.head()| ts_code | trade_date | open | high | low | close | pre_close | change | pct_chg | vol | amount | 收盘价 | 中界线 | 阻力线 | 支撑线 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| trade_date |

from bokeh.plotting import figure, show

# Define Bollinger Bands.

upperband = df['阻力线']

lowerband = df['支撑线']

x_data = df.index

# Bollinger shading glyph:

band_x = np.append(x_data, x_data[::-1])

band_y = np.append(lowerband, upperband[::-1])

# output_file('bollinger.html', title='Bollinger bands (file)')

p = figure(x_axis_type='datetime', title="Bollinger Bands")

p.grid.grid_line_alpha = 0.4

p.x_range.range_padding = 0

p.plot_height = 600

p.plot_width = 800

p.patch(band_x, band_y, color='#7570B3', fill_alpha=0.2) # 填充补丁,填充颜色透明度等

from bokeh.io import output_notebook, show

output_notebook()

show(p)

<div class="bk-root">

<a href="https://bokeh.org" target="_blank" class="bk-logo bk-logo-small bk-logo-notebook"></a>

<span id="1175">Loading BokehJS ...</span>

</div>

# 年化收益率

annual_profit=(1+(df.head(1)['close'].values[0]/df.tail(1)['close'].values[0]-1))**(250/df.shape[0])-1

annual_profit

0.2026992772623244

# 最大回撤

highest_close=df['close'].max()

df['dropdown']=(1-df['close']/highest_close)

max_dropdown=df['dropdown'].max()

print( 'max dropdown is %.2f%s' % (max_dropdown*100,'%'))

max dropdown is 33.47%

# https://blog.csdn.net/weixin_46274168/article/details/115652079?ops_request_misc=%7B%22request%5Fid%22%3A%22162393217516780366593704%22%2C%22scm%22%3A%2220140713.130102334.pc%5Fall.%22%7DARMA时间序列预测

import numpy as np

import pandas as pd

import statsmodels.tsa.api as smt

from statsmodels.tsa.api import ARIMA

import matplotlib.pyplot as plt

plt.rcParams['font.sans-serif'] = ['SimHei'] # 用来正常显示中文标签

plt.rcParams['axes.unicode_minus'] = False #当坐标轴有负号的时候可以显示负号

%matplotlib inline

import warnings

warnings.filterwarnings("ignore")

def draw_ac_pac(series, nlags=30):

fig = plt.figure(figsize=(10, 8))

# 设置子图

ts_ax = fig.add_subplot(311)

acf_ax = fig.add_subplot(312)

pacf_ax = fig.add_subplot(313)

# 绘制图像

ts_ax.set_title('time series')

acf_ax.set_title('autocorrelation coefficient')

pacf_ax.set_title('partial autocorrelation coefficient')

ts_ax.plot(series)

smt.graphics.plot_acf(series, lags=nlags, ax=acf_ax)

smt.graphics.plot_pacf(series, lags=nlags, ax=pacf_ax)

# 自适应布局

plt.tight_layout()

plt.show()

# 将日期设为索引

df.index = pd.to_datetime(df['trade_date'], format='%Y%m%d')

# 可视化自相关和偏自相关系数

draw_ac_pac(df['close'], nlags=30)

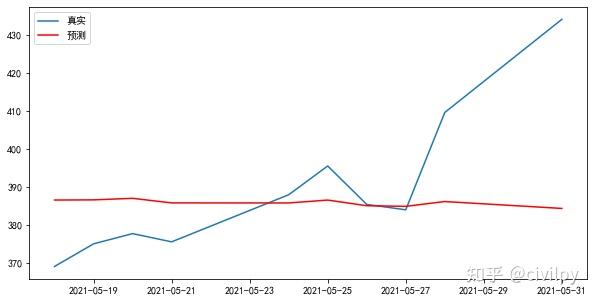

# 划分训练数据和测试数据

train_data = df['close'][:-10]

test_data = df['close'][-10:]

# 定义全局变量

min_aic = np.inf

best_order = None

best_arima = None

# 遍历范围

counter = 5

# 循环遍历

for i in range(counter):

for k in range(counter):

for j in range(counter):

try:

tmp_arima = ARIMA(train_data, order=(i, k, j)).fit(method='mle', trend='nc')

tmp_aic = tmp_arima.aic

if tmp_aic < min_aic:

min_aic = tmp_aic

best_order = (i, k, j)

best_arima = tmp_arima

except:

continue

# 打印最优结果

print('order', best_order) # (2, 3, 3) 经过3次差分可以实现平衡

print('para', best_arima.params)

order (2, 2, 3)

para ar.L1.D2.close -0.821138

ar.L2.D2.close -0.811198

ma.L1.D2.close 0.025065

ma.L2.D2.close -0.011166

ma.L3.D2.close -0.940427

dtype: float64

# 预测10天后的股票价格

result = best_arima.forecast(10)

result # 3个数组分别表示预测值 、 95%置信度的偏差、置信区间

(array([384.36189055, 386.17426305, 384.90800925, 385.07422427,

386.561561 , 385.80205797, 385.81582908, 387.01726794,

386.61618881, 386.56756425]),

array([12.73361992, 19.92899207, 25.41943537, 29.13619276, 33.27661759,

37.25556235, 40.40642813, 43.81383802, 47.2579767 , 50.20956255]),

array([[359.4044541 , 409.31932699],

[347.11415635, 425.23436975],

[335.08683142, 434.72918709],

[327.96833582, 442.18011273],

[321.340589 , 451.782533 ],

[312.78249754, 458.8216184 ],

[306.6206852 , 465.01097296],

[301.14372339, 472.89081248],

[293.99225649, 479.24012112],

[288.15862996, 484.97649853]]))

# 构造DataFrame

df_plot= pd.DataFrame(df['close'][:10])

df_plot['predictions']=result[0]

# 绘图

fig = plt.figure(figsize=(10,5))

plt.plot(df_plot['close'],label='真实')

plt.plot(df_plot['predictions'], color='r',label='预测')

plt.legend()

plt.show()

年化收益率

import ffn

result=ffn.calc_total_return(df_plot['predictions'])

ann_result=ffn.annualize(result,10,one_year=250) # 根据10天数据计算交易日250天的年化收益率

ann_result

0.15379127222659505