Python股票价格预测-AR-中国平安

发布时间:2021-12-03

公开文章

Talk is cheap

获取数据

import tushare as ts

pro = ts.pro_api(' ++++++++++++++++ ') # 到tushare官网注册账号获取token

ts_code = '000001'

ts_code = ts_code+'.SZ'

ts_code

'000001.SZ'

df = pro.daily(ts_code=ts_code, start_date='20210101', end_date='20210531')

df.head()| ts_code | trade_date | open | high | low | close | pre_close | change | pct_chg | vol | amount |

|---|

ARMA时间序列预测

import numpy as np

import pandas as pd

import statsmodels.tsa.api as smt

from statsmodels.tsa.ar_model import AR

import matplotlib.pyplot as plt

plt.rcParams['font.sans-serif'] = ['SimHei'] # 用来正常显示中文标签

plt.rcParams['axes.unicode_minus'] = False #当坐标轴有负号的时候可以显示负号

import warnings

warnings.filterwarnings("ignore")

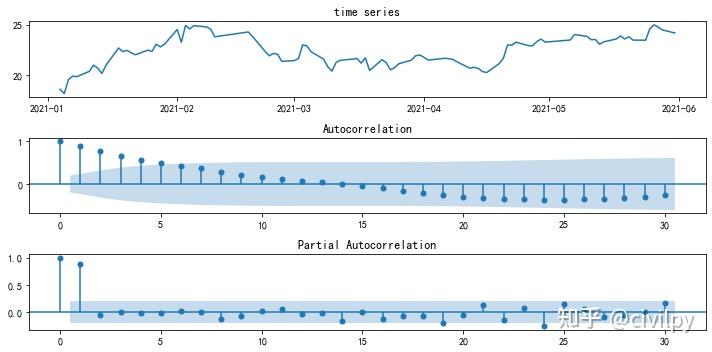

def draw_ac_pac(series, nlags=30):

fig = plt.figure(figsize=(10,5))

# 设置子图

ts_ax = fig.add_subplot(311)

acf_ax = fig.add_subplot(312)

pacf_ax = fig.add_subplot(313)

# 绘制图像

ts_ax.set_title('time series')

acf_ax.set_title('autocorrelation coefficient')

pacf_ax.set_title('partial autocorrelation coefficient')

ts_ax.plot(series)

smt.graphics.plot_acf(series, lags=nlags, ax=acf_ax)

smt.graphics.plot_pacf(series, lags=nlags, ax=pacf_ax)

# 自适应布局

plt.tight_layout()

plt.show()

# 将日期设为索引

df.index = pd.to_datetime(df['trade_date'], format='%Y%m%d')

# 可视化自相关和偏自相关系数

draw_ac_pac(df['close'], nlags=30)

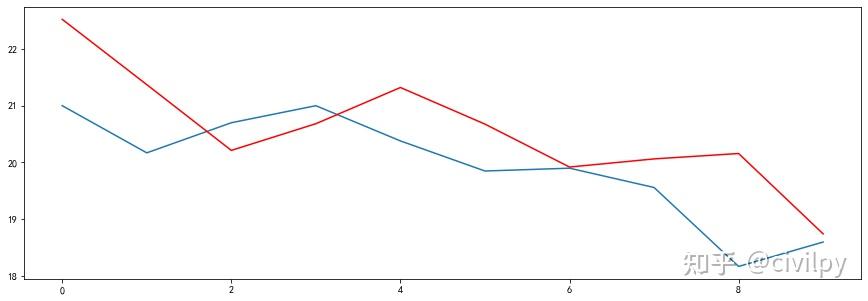

# 划分训练数据和测试数据

train = df['close'][:-10]

test = df['close'][-10:]

model_fit = AR(train).fit()

params = model_fit.params

p = model_fit.k_ar # 即时间序列模型中常见的p,即AR(p), ARMA(p,q), ARIMA(p,d,q)中的p。

history = train[-p:]

history = np.hstack(history).tolist()

test = np.hstack(test).tolist()

predictions = []

for t in range(len(test)):

lag = history[-p:]

yhat = params[0]

for i in range(p):

yhat += params[i+1] * lag[p-1-i]

predictions.append(yhat)

obs = test[t]

history.append(obs)

print('MSE指标:',np.mean((np.array(test) - np.array(predictions))**2)) # 得到mean_squared_error, MSE

fig = plt.figure(figsize=(15,5))

plt.plot(test)

plt.plot(predictions, color='r')

plt.show()

MSE指标: 0.988321573905643

策略年化收益率

import ffn

df_plot = pd.DataFrame({'predictions':predictions})

result=ffn.calc_total_return(df_plot['predictions'])

ann_result=ffn.annualize(result,10,one_year=250) # 根据10天数据计算交易日250天的年化收益率

ann_result

-0.9898424754209083